Importing FedNow Payment File

What is Importing FedNow Request for Payment File

FedNow ® real-time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Importing FedNow payment files using different formats like ISO 20022 (XML), CSV, or JSON into your financial institution's system requires detailed understanding of each format's structure, as well as mapping the data to your institution's specific processing workflow.

Here’s a comprehensive guide to importing FedNow payment files using various formats:

1. Understanding the Formats

- ISO 20022 (XML): This is the standard format used by many financial systems, including FedNow, to exchange payment messages. It contains rich metadata and follows a structured XML format.

- CSV (Comma-Separated Values): A simpler file format with data separated by commas. It’s often used for batch processing but lacks the rich metadata of ISO 20022.

- JSON (JavaScript Object Notation): A lightweight data-interchange format that is human-readable and widely used in API-based systems. It is less structured than XML but easier to parse and work with in modern web systems.

2. File Import Process Overview

- ISO 20022 (XML): Primarily used in real-time payments, including FedNow. The XML format allows for detailed transactions with fields like sender, receiver, amount, currency, and more.

- CSV: This format is typically used for batch payments. It’s important to create a consistent format, where each column corresponds to a data field (e.g., sender, receiver, amount, reference).

- JSON: Primarily used for API communication and real-time integration. JSON messages are simple, but fields must be appropriately mapped to your financial system.

3. Steps for Importing FedNow Files

Step 1: Format Compatibility and System Preparation

- Ensure that your financial institution’s systems are capable of handling the chosen file format (ISO 20022 XML, CSV, or JSON). Most modern core banking systems will support one or more of these formats.

- If working with XML (ISO 20022), ensure your system supports FedNow-specific variations. ISO 20022 offers a detailed structure with message types like pacs.008 (Customer Credit Transfer), pacs.002 (Payment Status Report), and camt.053 (Bank Statement Reporting).

Step 2: Mapping Fields to Core Banking System

- For ISO 20022 (XML), map the XML elements (such as Creditor, Debtor, Amount, Currency) to your internal database fields.

- For CSV, map columns to fields (e.g., Sender_Name, Recipient_Account, Transaction_Amount). Each row represents a transaction.

- For JSON, map the key-value pairs from the JSON message to the database (e.g., "sender_name": "John Doe" maps to your sender_name field).

Step 3: Validate and Test File Import

- ISO 20022 (XML): Ensure that the imported file adheres to the FedNow ISO 20022 schema. Use XML validators to check for errors before importing into the core banking system.

- CSV: Ensure that CSV files follow the required format (e.g., correct number of columns, no missing or extra commas).

- JSON: Use JSON validation tools to confirm the structure is correct. API endpoints should be tested for compatibility if using JSON for API-based imports.

Step 4: Error Handling

- Implement robust error handling. For ISO 20022, if the file is not valid or some fields are incorrect, your system should reject the file and send a rejection message (pacs.002 for negative acknowledgment).

- For CSV and JSON, build custom error-handling mechanisms. Incorrect files should trigger alerts, and invalid rows should be logged for review without halting the entire batch process.

Step 5: Process Payments

- Once files are successfully imported, the payments are processed. For FedNow, real-time payments are executed, and confirmation messages are sent back.

- Ensure that your system updates account balances, handles transaction statuses, and generates reports.

4. FedNow-Specific Import Considerations

For ISO 20022 (XML)

- Message Types: Understand the FedNow-specific message types. For example, pacs.008 is used for credit transfers, pacs.002 for status updates, and camt.053 for bank statements.

- Extensions: FedNow may introduce specific extensions to the ISO 20022 standard, and your system needs to handle those additional fields.

For CSV Files

- Ensure the CSV file format has sufficient fields to carry necessary FedNow payment information, such as transaction reference, originator, recipient, amount, and timestamps.

- Since FedNow supports real-time payments, CSV is best suited for batch uploads, possibly for bulk transfers.

For JSON Files

- JSON is usually implemented for API-based real-time processing. When using JSON for FedNow payments, ensure the endpoints are secure, and JSON structures are consistently validated for compatibility.

- Example JSON structure for a FedNow payment:

Json

{

"transaction_id": "123456789",

"sender": {

"name": "John Doe",

"account_number": "123456789"

},

"receiver": {

"name": "Jane Doe",

"account_number": "987654321"

},

"amount": 150.75,

"currency": "USD",

"timestamp": "2023-08-12T14:30:00Z"

}

5. Tools and Resources

- XML Parsing Tools: Use tools like XPath or XML libraries to parse and validate ISO 20022 files before importing them into your system.

- CSV Processing: Most programming languages support CSV reading, validation, and parsing. Libraries in Python, Java, and C# can automate file imports.

- JSON Parsers: Many modern systems use JSON parsers integrated within the API handling mechanism to validate and process incoming JSON files.

6. Testing and Monitoring

- Sandbox Testing: Use FedNow’s sandbox environment to test the import and payment process. This ensures that real-time payments are processed correctly and that files are formatted and parsed accurately.

- Monitoring: Implement a monitoring system that tracks incoming files, successful imports, and errors. This is crucial for real-time payments.

Conclusion

Importing FedNow payment files, whether in ISO 20022 (XML), CSV, or JSON format, requires mapping the file structure to your financial institution’s database and ensuring compliance with FedNow's specifications. With proper validation, testing, and error handling, your institution can seamlessly integrate real-time payments into its existing system.

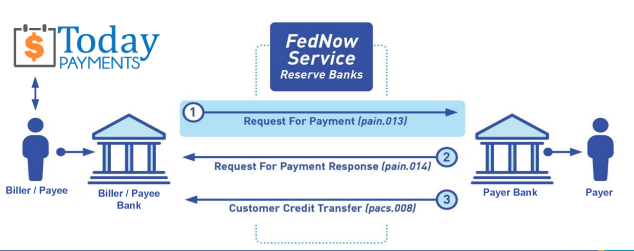

Creation Request for Payment Bank File

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" with Real-Time Payments to work with Billers / Payees to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer / Customer Routing Transit and Deposit Account Number may be required or Nickname, Alias to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) We add a URI for each separate Payer transaction. Using URI, per transaction, will identify and reconcile your Accounts Receivable.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Start using our Bank Reconciliation and Aging of Request for Payments:

Dynamic integrated with FedNow & Real-Time Payments (RtP) Bank Reconciliation: Accrual / Cash / QBO - Undeposited Funds

Contact Us for Request For Payment payment processing